Inventory Watch: April 4, 2022

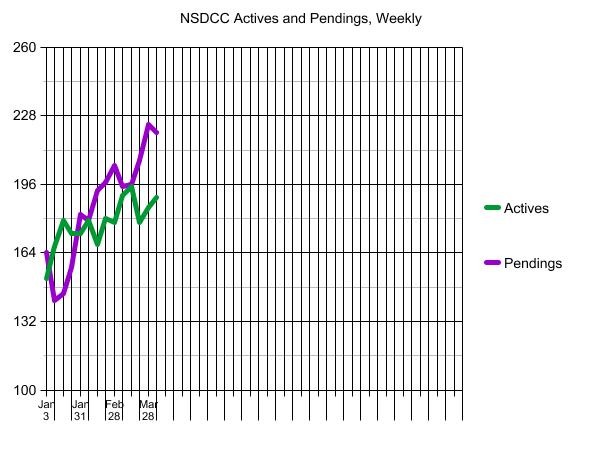

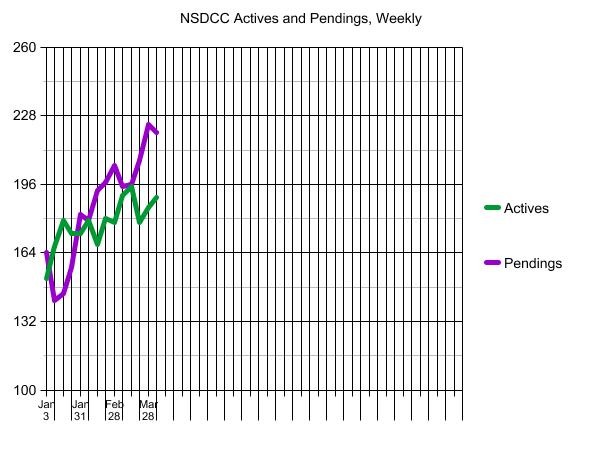

It is natural to have more closings during the last week of the month, and the dip in the pendings count wasn’t as bad this month as it was last month. This is where you will see the first signs of any concern on behalf of buyers about interest rates, etc.

Everyone was talking about them at open house over the weekend. But we’re still going to sell my listing for well over the list price today!

The $0 – $1,500,000 Market:

| Date |

NSDCC Active Listings |

Avg. LP/sf |

Avg. DOM |

# of Pendings |

| Jan 3, 2022 |

9 |

$832/sf |

35 |

36 |

| Jan 10 |

9 |

$766/sf |

28 |

29 |

| Jan 17 |

13 |

$773/sf |

26 |

27 |

| Jan 24 |

9 |

$818/sf |

15 |

29 |

| Jan 31 |

14 |

$752/sf |

14 |

31 |

| Feb 7 |

13 |

$774/sf |

12 |

32 |

| Feb 14 |

11 |

$826/sf |

12 |

35 |

| Feb 21 |

7 |

$889/sf |

17 |

38 |

| Feb 28 |

12 |

$888/sf |

17 |

33 |

| Mar 7 |

9 |

$1,017/sf |

21 |

33 |

| Mar 14 |

14 |

$847/sf |

18 |

31 |

| Mar 21 |

8 |

$912/sf |

26 |

36 |

| Mar 28 |

10 |

$914/sf |

25 |

28 |

| Apr 4 |

10 |

$782/sf |

33 |

34 |

The $1,500,000 – $2,000,000 Market:

| Date |

NSDCC Active Listings |

Avg. LP/sf |

Avg. DOM |

# of Pendings |

| Jan 3, 2022 |

8 |

$842/sf |

52 |

36 |

| Jan 10 |

13 |

$751/sf |

28 |

29 |

| Jan 17 |

16 |

$736/sf |

33 |

27 |

| Jan 24 |

16 |

$801/sf |

17 |

27 |

| Jan 31 |

15 |

$696/sf |

14 |

34 |

| Feb 7 |

15 |

$765/sf |

17 |

34 |

| Feb 14 |

10 |

$726/sf |

19 |

38 |

| Feb 21 |

19 |

$715/sf |

15 |

39 |

| Feb 28 |

9 |

$660/sf |

12 |

46 |

| Mar 7 |

16 |

$789/sf |

15 |

46 |

| Mar 14 |

17 |

$837/sf |

8 |

44 |

| Mar 21 |

18 |

$867/sf |

11 |

43 |

| Mar 28 |

14 |

$838/sf |

15 |

48 |

| Apr 4 |

18 |

$762/sf |

25 |

42 |

The $2,000,000 – $3,000,000 Market:

| Date |

NSDCC Active Listings |

Avg. LP/sf |

Avg. DOM |

# of Pendings |

| Jan 3, 2022 |

18 |

$1,080/sf |

127 |

43 |

| Jan 10 |

23 |

$1,038/sf |

85 |

37 |

| Jan 17 |

26 |

$1,044/sf |

80 |

41 |

| Jan 24 |

28 |

$1,015/sf |

37 |

42 |

| Jan 31 |

22 |

$949/sf |

38 |

47 |

| Feb 7 |

26 |

$919/sf |

29 |

42 |

| Feb 14 |

22 |

$997/sf |

37 |

49 |

| Feb 21 |

21 |

$966/sf |

33 |

54 |

| Feb 28 |

26 |

$905/sf |

32 |

57 |

| Mar 7 |

29 |

$922/sf |

28 |

57 |

| Mar 14 |

20 |

$852/sf |

26 |

58 |

| Mar 21 |

17 |

$928/sf |

26 |

60 |

| Mar 28 |

34 |

$927/sf |

12 |

65 |

| Apr 4 |

32 |

$927/sf |

20 |

69 |

The $3,000,000 – $4,000,000 Market:

| Date |

NSDCC Active Listings |

Avg. LP/sf |

Avg. DOM |

# of Pendings |

| Jan 3, 2022 |

19 |

$1,230/sf |

90 |

26 |

| Jan 10 |

22 |

$1,210/sf |

76 |

25 |

| Jan 17 |

19 |

$1,207/sf |

86 |

23 |

| Jan 24 |

17 |

$1,129/sf |

92 |

24 |

| Jan 31 |

21 |

$1,172/sf |

70 |

22 |

| Feb 7 |

19 |

$1,169/sf |

67 |

25 |

| Feb 14 |

19 |

$1,234/sf |

65 |

28 |

| Feb 21 |

21 |

$1,279/sf |

69 |

28 |

| Feb 28 |

22 |

$1,214/sf |

64 |

25 |

| Mar 7 |

27 |

$1,295/sf |

60 |

24 |

| Mar 14 |

27 |

$1,201/sf |

65 |

27 |

| Mar 21 |

23 |

$1,282/sf |

69 |

31 |

| Mar 28 |

25 |

$1,253/sf |

67 |

30 |

| Apr 4 |

30 |

$1,199/sf |

61 |

27 |

The $4,000,000+ Market:

| Date |

NSDCC Active Listings |

Avg. LP/sf |

Avg. DOM |

# of Pendings |

| Jan 3, 2022 |

100 |

$1,884/sf |

128 |

30 |

| Jan 10 |

105 |

$1,864/sf |

113 |

29 |

| Jan 17 |

109 |

$1,763/sf |

110 |

34 |

| Jan 24 |

105 |

$2,130/sf |

114 |

42 |

| Jan 31 |

102 |

$2,114/sf |

118 |

53 |

| Feb 7 |

109 |

$2,000/sf |

108 |

50 |

| Feb 14 |

108 |

$2,005/sf |

109 |

47 |

| Feb 21 |

113 |

$2,008/sf |

103 |

43 |

| Feb 28 |

111 |

$1,991/sf |

101 |

47 |

| Mar 7 |

115 |

$1,904/sf |

91 |

39 |

| Mar 14 |

121 |

$1,893/sf |

95 |

43 |

| Mar 21 |

116 |

$1,905/sf |

97 |

44 |

| Mar 28 |

104 |

$1,966/sf |

97 |

59 |

| Apr 4 |

103 |

$1,929/sf |

97 |

56 |

NSDCC Weekly New Listings and New Pendings

| Week |

New Listings |

New Pendings |

Total Actives |

Total Pendings |

| Jan 3, 2022 |

17 |

14 |

152 |

164 |

| Jan 10 |

39 |

18 |

167 |

142 |

| Jan 17 |

34 |

29 |

179 |

145 |

| Jan 24 |

41 |

40 |

173 |

157 |

| Jan 31 |

43 |

40 |

173 |

182 |

| Feb 7 |

43 |

38 |

179 |

179 |

| Feb 14 |

44 |

49 |

168 |

193 |

| Feb 21 |

51 |

38 |

180 |

197 |

| Feb 28 |

39 |

39 |

179 |

205 |

| Mar 7 |

54 |

37 |

191 |

195 |

| Mar 14 |

48 |

51 |

195 |

196 |

| Mar 21 |

39 |

46 |

178 |

207 |

| Mar 28 |

53 |

50 |

185 |

224 |

| Apr 4 |

46 |

40 |

190 |

220 |