Inventory Watch: May 1, 2023

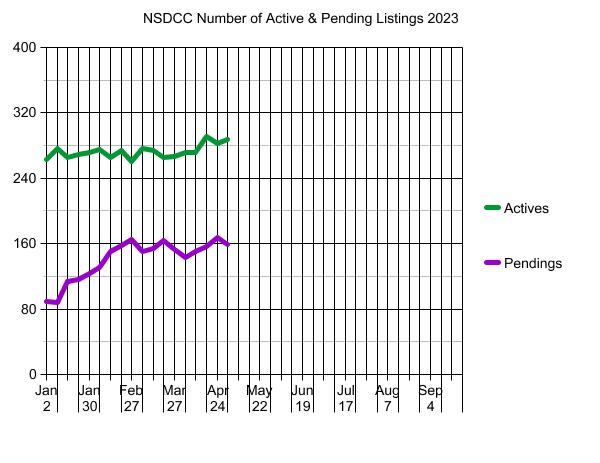

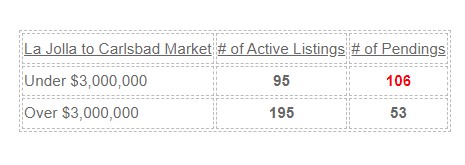

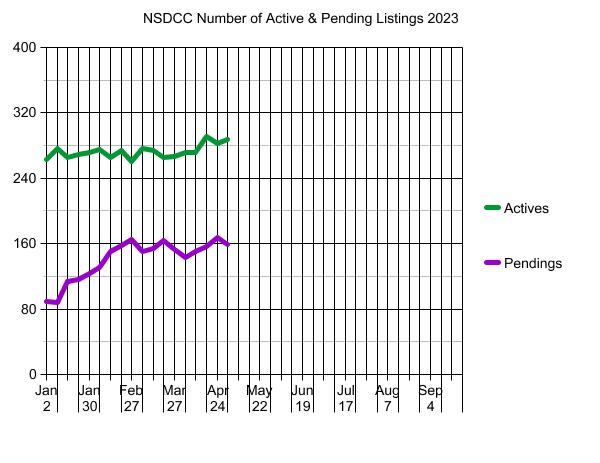

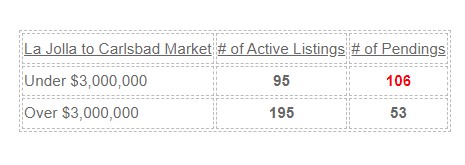

The lower-end is sizzling with more pendings than active listings, and the higher-end really isn’t bad either with a ratio under 4:1 (there were years when the RSF market was 10:1):

The unsold listings should start stacking up by next month and the number of actives drift higher until August/September. By then, the unsuccessful sellers will tire of the failure and decide to wait for the market to get ‘better’.

But for now, this has to be the healthiest market anyone could have imagined with the higher rates!

The $0 – $1,500,000 Market:

| Date |

NSDCC Active Listings |

Avg. LP/sf |

Avg. DOM |

# of Pendings |

| Jan 2, 2023 |

22 |

$719/sf |

75 |

15 |

| Jan 9 |

26 |

$687/sf |

50 |

14 |

| Jan 16 |

23 |

$701/sf |

52 |

20 |

| Jan 23 |

25 |

$751/sf |

60 |

21 |

| Jan 30 |

23 |

$788/sf |

45 |

25 |

| Feb 6 |

18 |

$750/sf |

59 |

24 |

| Feb 13 |

18 |

$770/sf |

48 |

26 |

| Feb 20 |

17 |

$778/sf |

49 |

26 |

| Feb 27 |

18 |

$802/sf |

48 |

23 |

| Mar 6 |

22 |

$802/sf |

44 |

14 |

| Mar 13 |

22 |

$747/sf |

45 |

16 |

| Mar 20 |

16 |

$826/sf |

49 |

21 |

| Mar 27 |

17 |

$853/sf |

47 |

20 |

| Apr 3 |

19 |

$803/sf |

37 |

20 |

| Apr 10 |

11 |

$778/sf |

53 |

30 |

| Apr 17 |

15 |

$690/sf |

44 |

27 |

| Apr 24 |

12 |

$682/sf |

33 |

25 |

| May 1 |

11 |

$795/sf |

35 |

27 |

The $1,500,000 – $2,000,000 Market:

| Date |

NSDCC Active Listings |

Avg. LP/sf |

Avg. DOM |

# of Pendings |

| Jan 2, 2023 |

45 |

$809/sf |

60 |

18 |

| Jan 9 |

55 |

$828/sf |

53 |

19 |

| Jan 16 |

46 |

$838/sf |

53 |

30 |

| Jan 23 |

43 |

$793/sf |

52 |

31 |

| Jan 30 |

40 |

$778/sf |

54 |

34 |

| Feb 6 |

42 |

$814/sf |

46 |

30 |

| Feb 13 |

35 |

$823/sf |

51 |

39 |

| Feb 20 |

34 |

$801/sf |

47 |

40 |

| Feb 27 |

27 |

$846/sf |

33 |

45 |

| Mar 6 |

29 |

$893/sf |

33 |

41 |

| Mar 13 |

32 |

$850/sf |

33 |

39 |

| Mar 20 |

27 |

$872/sf |

36 |

41 |

| Mar 27 |

22 |

$832/sf |

39 |

36 |

| Apr 3 |

21 |

$779/sf |

27 |

36 |

| Apr 10 |

22 |

$816/sf |

26 |

33 |

| Apr 17 |

27 |

$797/sf |

21 |

33 |

| Apr 24 |

28 |

$856/sf |

31 |

34 |

| Apr 24 |

28 |

$856/sf |

31 |

34 |

| May 1 |

30 |

$789/sf |

28 |

36 |

The $2,000,000 – $3,000,000 Market:

| Date |

NSDCC Active Listings |

Avg. LP/sf |

Avg. DOM |

# of Pendings |

| Jan 2, 2023 |

52 |

$869/sf |

69 |

30 |

| Jan 9 |

57 |

$940/sf |

66 |

31 |

| Jan 16 |

50 |

$948/sf |

61 |

36 |

| Jan 23 |

51 |

$949/sf |

58 |

35 |

| Jan 30 |

54 |

$964/sf |

55 |

34 |

| Feb 6 |

60 |

$930/sf |

51 |

42 |

| Feb 13 |

51 |

$1,038/sf |

52 |

47 |

| Feb 20 |

58 |

$1,022/sf |

47 |

46 |

| Feb 27 |

56 |

$1,064/sf |

52 |

49 |

| Mar 6 |

57 |

$995/sf |

50 |

50 |

| Mar 13 |

55 |

$1,015/sf |

53 |

47 |

| Mar 20 |

50 |

$1,011/sf |

58 |

50 |

| Mar 27 |

54 |

$1,039/sf |

49 |

47 |

| Apr 3 |

54 |

$1,035/sf |

52 |

38 |

| Apr 10 |

55 |

$1,004/sf |

48 |

42 |

| Apr 17 |

64 |

$985/sf |

47 |

46 |

| Apr 24 |

57 |

$1,001/sf |

43 |

50 |

| May 1 |

57 |

$1,008/sf |

42 |

45 |

The $3,000,000 – $4,000,000 Market:

| Date |

NSDCC Active Listings |

Avg. LP/sf |

Avg. DOM |

# of Pendings |

| Jan 2, 2023 |

29 |

$1,236/sf |

85 |

6 |

| Jan 9 |

29 |

$1,180/sf |

80 |

5 |

| Jan 16 |

31 |

$1,196/sf |

73 |

8 |

| Jan 23 |

33 |

$1,201/sf |

71 |

7 |

| Jan 30 |

37 |

$1,218/sf |

70 |

6 |

| Feb 6 |

34 |

$1,236/sf |

75 |

12 |

| Feb 13 |

43 |

$1,333/sf |

68 |

11 |

| Feb 20 |

39 |

$1,392/sf |

71 |

18 |

| Feb 27 |

37 |

$1,323/sf |

68 |

22 |

| Mar 6 |

49 |

$1,222/sf |

56 |

20 |

| Mar 13 |

49 |

$1,312/sf |

49 |

22 |

| Mar 20 |

46 |

$1,321/sf |

52 |

25 |

| Mar 27 |

50 |

$1,329/sf |

52 |

25 |

| Apr 3 |

49 |

$1,342/sf |

51 |

23 |

| Apr 10 |

50 |

$1,321/sf |

57 |

24 |

| Apr 17 |

47 |

$1,342/sf |

59 |

26 |

| Apr 24 |

49 |

$1,281/sf |

63 |

28 |

| May 1 |

53 |

$1,227/sf |

62 |

23 |

The $4,000,000+ Market:

| Date |

NSDCC Active Listings |

Avg. LP/sf |

Avg. DOM |

# of Pendings |

| Jan 2, 2023 |

121 |

$1,744/sf |

126 |

21 |

| Jan 9 |

119 |

$1,716/sf |

123 |

20 |

| Jan 16 |

120 |

$1,761/sf |

121 |

26 |

| Jan 23 |

122 |

$1,707/sf |

119 |

27 |

| Jan 30 |

120 |

$1,680/sf |

121 |

30 |

| Feb 6 |

125 |

$1,714/sf |

118 |

28 |

| Feb 13 |

121 |

$1,750/sf |

116 |

32 |

| Feb 20 |

129 |

$1,725/sf |

112 |

33 |

| Feb 27 |

124 |

$1,743/sf |

115 |

31 |

| Mar 6 |

122 |

$1,753/sf |

109 |

28 |

| Mar 13 |

120 |

$1,782/sf |

109 |

32 |

| Mar 20 |

129 |

$1,783/sf |

106 |

28 |

| Mar 27 |

127 |

$1,781/sf |

106 |

27 |

| Apr 3 |

131 |

$1,774/sf |

105 |

27 |

| Apr 10 |

136 |

$1,788/sf |

107 |

24 |

| Apr 17 |

140 |

$1,776/sf |

108 |

27 |

| Apr 24 |

141 |

$1,771/sf |

107 |

31 |

| May 1 |

142 |

$1,760/sf |

105 |

30 |

NSDCC Weekly New Listings and New Pendings

| Week |

New Listings |

New Pendings |

Total Actives |

Total Pendings |

| Jan 2, 2023 |

11 |

6 |

263 |

89 |

| Jan 9 |

36 |

15 |

277 |

88 |

| Jan 16 |

36 |

34 |

266 |

114 |

| Jan 23 |

36 |

22 |

269 |

116 |

| Jan 30 |

32 |

25 |

272 |

123 |

| Feb 6 |

46 |

33 |

275 |

131 |

| Feb 13 |

30 |

35 |

265 |

150 |

| Feb 20 |

43 |

34 |

274 |

158 |

| Feb 27 |

27 |

30 |

260 |

165 |

| Mar 6 |

45 |

28 |

276 |

150 |

| Mar 13 |

38 |

38 |

274 |

154 |

| Mar 20 |

39 |

37 |

265 |

164 |

| Mar 27 |

36 |

25 |

267 |

153 |

| Apr 3 |

37 |

28 |

271 |

143 |

| Apr 10 |

36 |

39 |

272 |

151 |

| Apr 17 |

47 |

27 |

291 |

157 |

| Apr 24 |

46 |

41 |

282 |

167 |

| May 1 |

59 |

31 |

288 |

159 |

NSDCC Weekly LP Quartiles

| Week |

1st Quartile |

2nd Quartile (Median LP) |

3rd Quartile |

| Jan 2, 2023 |

$2,095,000 |

$3,695,000 |

$5,995,000 |

| Jan 9 |

$1,990,000 |

$3,495,000 |

$5,775,000 |

| Jan 16 |

$2,000,000 |

$3,574,000 |

$5,995,000 |

| Jan 23 |

$2,099,000 |

$3,595,000 |

$5,999,000 |

| Jan 30 |

$2,195,000 |

$3,525,000 |

$5,942,000 |

| Feb 6 |

$2,195,000 |

$3,598,000 |

$6,845,000 |

| Feb 13 |

$2,300,000 |

$3,795,000 |

$6,495,000 |

| Feb 20 |

$2,397,500 |

$3,950,000 |

$6,197,500 |

| Feb 27 |

$2,480,800 |

$3,970,000 |

$6,845,000 |

| Mar 6 |

$2,395,000 |

$3,749,500 |

$5,995,000 |

| Mar 13 |

$2,397,000 |

$3,772,500 |

$5,997,000 |

| Mar 20 |

$2,580,000 |

$3,995,000 |

$6,800,000 |

| Mar 27 |

$2,595,000 |

$3,995,000 |

$6,845,000 |

| Apr 3 |

$2,699,000 |

$3,995,000 |

$6,750,000 |

| Apr 10 |

$2,799,500 |

$4,074,997 |

$6,895,000 |

| Apr 17 |

$2,600,000 |

$3,995,000 |

$6,597,000 |

| Apr 24 |

$2,685,000 |

$4,074,997 |

$6,895,000 |

| May 1 |

$2,695,000 |

$3,999,000 |

$6,495,000 |